National Pension Scheme (NPS)

National Pension Scheme (NPS), a government-sponsored pension scheme that was launched in January 2004 for government employees and later in 2009 it was made open to all sections. Subscribers can contribute regularly in a pension account during their working life, withdraw a part of the corpus in a lump sum and use the remaining corpus to buy an annuity to secure a regular income after retirement.

Who can join NPS?

Any Indian citizen between 18 and 60 years can join NPS. The only condition is that the person must comply with know your customer (KYC) norms.

Why is it essential to invest in NPS (National Pension Scheme)?

1 Low-cost management charge 0.01% P.A.

2 Secure & Transparent Regulated by PFRDA, Complete information on investments available online

3 Tax Efficiency save 45,000/- U/s 80CCD, subsection (1,2 & 1b)

4 flexible Investment option mode of payment active choice/ auto choice.

5 Attractive returns on investment.

6 60% tax free lump sum withdrawals on maturity

7 NPS contribution made by employer, up to 10% of Salary (Basic+ DA) is deductible from gross taxable salary u/s 80CCD (2).

What is the minimum contribution in NPS?

You have to contribute a minimum of Rs 6,000 every year in your Tier-I account in a financial year.

What are the tax benefits available for NPS?

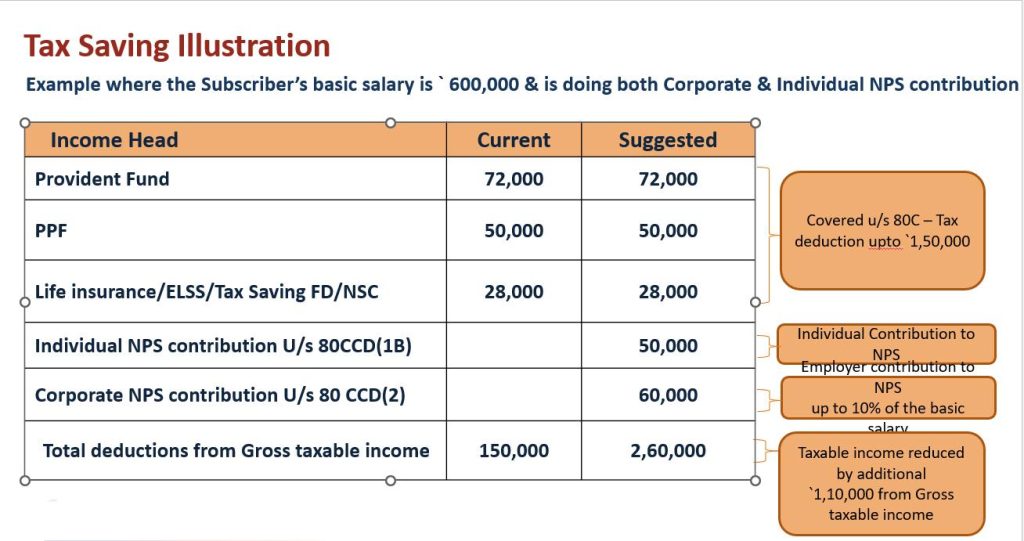

- An employee’s own contribution is eligible for a tax deduction –up to 10 percent of the salary (basic plus DA) under Section 80CCD (1) of the Income Tax Act within the overall ceiling of Rs 1.5 lakh allowed under Section 80C and Section 80CCE.

The employer’s contribution to NPS is exempted under Section 80CCD

- Moreover, individuals can claim an additional deduction of up to Rs 50,000 under Section 80CCD (1B), which is in addition to Rs 1.5 lakh permitted under Section 80C.

- A self-employed person can also contribute 10 percent of his gross income under Section 80CCD (1) in NPS.

What are Tier-I and Tier-II accounts?

NPS offers two accounts: Tier-I and Tier-II accounts. Tier-I is a mandatory account and Tier-II is voluntary. The big difference between the two is the withdrawal of money invested in them. You cannot withdraw the entire money from a Tier-I account till your retirement. Even on retirement, there are restrictions on withdrawal on the Tier-I account. The subscriber is free to withdraw the entire money from the Tier-II account.

What are the investment choices available in NPS?

The NPS offers two choices:

- Active Choice: This option allows the investor to decide how the money should be invested in different assets.

- Auto choice or lifecycle fund: This is the default option which invests money automatically in line with the age of the subscriber.

Partial withdrawal from NPS

PFRDA has eased the norms of partial withdrawal from NPS

- Subscriber can now withdraw 3 times from NPS corpus after completing 3 years in the system.

- The gap of 5 years between two withdrawal has been removed

- Subscriber can withdraw 25% of contribution made by them; excluding contribution made by employer & interest generated

Withdrawal is permitted for the below reasons

- Education of self & children

- Marriage of children

- Due to critical illness of self / spouse / children

- Construction / purchase of residential property

- For starting a business

So start NPS and avail tax benefits!